As a result of favorable regulatory changes, increasing push toward market liberalization, and enhanced digital penetration by consumers, digital banking has been gaining ground in the APAC region over the past few years. Recently, an Australia-based financial services company Westpac partnered with SocietyOne—a leading marketplace lender in Australia—as the second partner to join its new digital banking-as-a-service platform.

This partnership is expected to enable the bank to reach new customers through a low-cost operating and distribution model. Moreover, this announcement highlights the efforts by Australia’s incumbent banks to step up digitization efforts to defend their over 70 percent market share against neobanks / digital banks.

Here are some of the prominent reasons behind the increasing push toward digital banking in Asia.

The Ever-increasing Competition

The new emerging players are joining an increasingly competitive landscape where digital pure players and consortia are already fiercely competing against incumbents that are introducing digital offerings at an accelerated pace. A McKinsey report released in January 2021 identified at least 30 digital banking offerings across the Asia-pacific (APAC) in markets including China, Japan, South Korea, Taiwan, Hong Kong, India, Thailand, Vietnam, Philippines, Indonesia, and Australia.

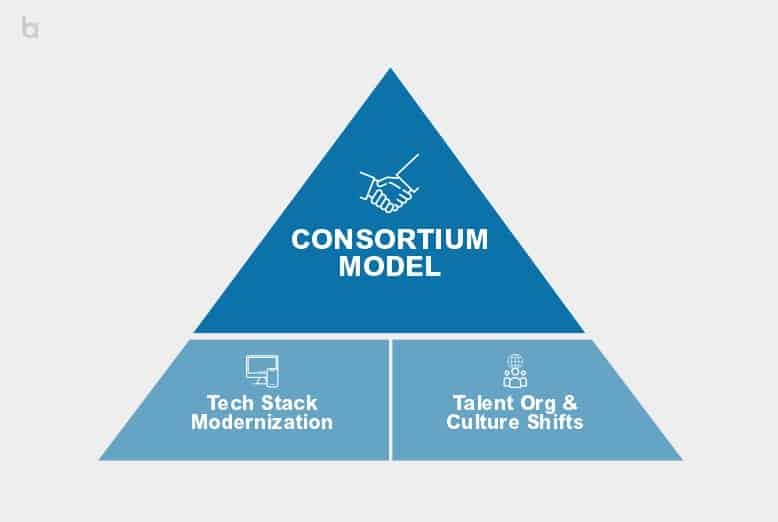

A Consortium Business Model

Successful digital banks in Asia often operate under a consortium business model which gives them a path to scaling relatively quickly, the report notes. Additionally, consortia have so far been awarded the highest number of licenses in recent licensing processes in Taiwan, South Korea, and Hong Kong. Moreover, in Singapore, two of the four nominees eventually awarded digital banking licenses were consortia.

Co-existence of Banks and Digital Challengers

Amid the fierce competition in the finance and banking industry, incumbents are rapidly digitizing their offerings. The COVID-19 pandemic has forced customers to turn to digital channels and mobile banking, leading to many of these incumbents witnessing record growth levels over the past year. Digital banks have been praised for their potential to bring financial services to the large population of unbanked individuals and small businesses across the region. However, with incumbents rapidly ramping up their digital efforts, it is still hard to predict who will come out as a winner of Asia’s digital banking competition.

Also read: Why is Vietnam the Top-performing Economy during the COVID-19 Pandemic?