The tradition of the Finance Minister walking with a briefcase on a budget day with all camera shutters around is a fascinating moment. However, this tradition came to end in 2019, with the Finance Minister Nirmala Sitharaman carrying a red fourfold cloth.

In the past two years, the gimmick of carrying the budget in the cloth may have worked for the government.

But, in 2022, the announcement of a tax on the digital asset and with no change in the tax slabs and less to minimum relief to the middle-class income group, has brought the discussion back on the dining tables of the majority of the population.

During her Budget speech, Finance Minister Nirmala Sitharaman stated, “Income from the transfer of any virtual digital assets will be taxed at 30%.”

The introduction of virtual digital assets taxation includes cryptocurrencies and Non-Fungible Tokens (NFTs). Also, the taxation of virtual digital assets indicates towards new approach of the government. This also means that there will be more norms, rules and other aspects that will increase more attention of towards virtual digital assets.

So, the next question arises, what is a digital asset and how will it affect you?

What is Digital Asset or a virtual Digital asset?

According to the Finance Bill, a virtual digital asset is any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme, and can be transferred, stored or traded electronically.

How will Digital assets or virtual Digital assets affect you?

As an investor, you have to pay 30 percent tax on the returns that you make from trading or investing in cryptocurrencies or other digital assets such as NFTs. Also, in case you bear any losses from the transfer of a virtual digital asset, you cannot set off against any other income.

In case of payment made in relation to transfer of virtual digital asset at the rate of 1 percent of such consideration above a monetary threshold, you have to provide for TSD on that particular payment made.

Also, if you planning for gifting of virtual asset, it will tax the person who will receive it.

To understand it further, we will learn about a few concepts such as cryptocurrencies and NFTs.

So, what is a cryptocurrency and how does it work?

Similar to a medium of exchange such as the rupee, dollar, or any other currency around the world, cryptocurrency is a medium of exchange in a digital form. Currently, bitcoin is considered as one of the largest and best-known cryptocurrencies in the world according to market capitalization.

The craze for cryptocurrency grew in 2019 when the value of bitcoin reached $20,000 per coin for the first time. In the last few years, the value of cryptocurrencies has been gradually rising, attracting more and more investors. Along with bitcoin, there are several other cryptocurrencies that have gained popularity, such as Dogecoin.

Platforms that offer Cryptocurrency in India: CoinDCX, WazirX, CoinSwitch Kuber, UnoCoin, Bitbns

How does Cryptocurrency work?

What is Blockchain?

Blockchain is a public ledger which shows all the transactions ever made; anonymously or in encrypted form. After the financial crisis of 2008, Satoshi Nakamoto was the person who is responsible for the conceptualizating an accounting system for cryptocurrency.

What are NFTs?

Interestingly, India discovered NFTs in 2021, while it has been around since 2014. NFTs came into the limelight when celebrities started using them as a digital token for launching their own NFT collections.

Non-Fungible Tokens (NFT) is a kind of digital asset that symbolizes things or objects like in-game articles, art, music, videos, social media posts and similar real-world objects. You cannot exchange or interchange with anything else as it is unique and irreplaceable.

symbolizes real world objects such as music, art, in-game articles, videos or even social media posts.

Platforms that offer NFTs in India: Wazirx, Bollycoin, RARIO, Always First

Cryptocurrency Taxation Around The World

1. US

IRS also known as Internal Revenue Services; is a U.S. agency that is responsible for the collection of primary income tax and enforcement of tax laws. In the U.S., IRS treats cryptocurrency as a capital asset, where there is no tax on buying cryptocurrency.

| Tenure | Tax |

| Held for one year or less | The short term gain tax |

| Held for more than one-year | Long term gain tax |

In tax rate for Bitcoin:

| Tenure | Tax |

| Within one year | between 0 % and 37 % |

| More than a year | From 0 % to 15 %, or even up to 20 % |

You can offset income tax up to $3000 in total if there are any losses from sales.

2. Canada

Canada Revenue Agency (CRA); an agency responsible for the administration of tax laws in Canada. In Canada, cryptocurrency is treated as a commodity, similar to the US, it is categorized under capital assets; like property or stocks.

| Income | Tax |

| first $49,020 of taxable income | 15% |

| $49,0201 – $98,040 | 20.5% |

| $98,041 – $151,978 | 26% |

| $151,979 – $216,511 | 29% |

| $216,512+ | 33% |

3. UK

Her Majesty’s Revenue and Customs (HMRC) is a non-ministerial department of the UK Government. The department is in charge of managing, collecting, administrating, and payment of taxes in the UK.

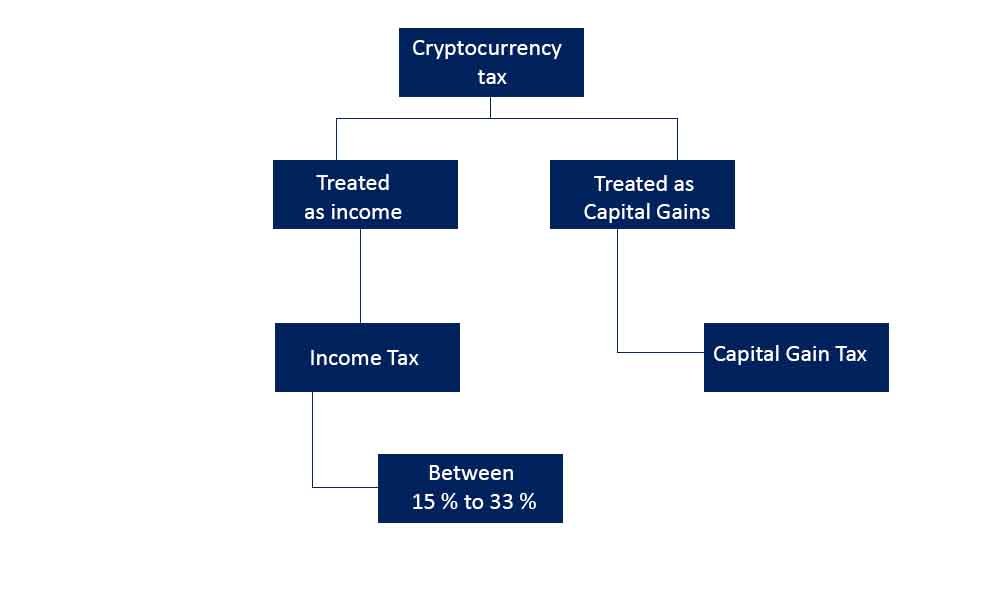

The taxation for cryptocurrency is quite similar to Canada’s system. In the UK, till date, there is no specific taxation for cryptocurrency or bitcoin. The gain from cryptocurrency will be charged under two categories; Income tax and Capital Gains. If the owner makes income from the cryptocurrency; he will have to pay income tax and if he makes any capital gain, the gain will be charged under capital gains.

| Income | Tax rate |

| up to £50,270 | 10% |

| up to £150,000 | 20% |

| more than £150,000 | 20% |

4. Australia

Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body that is responsible for administrating taxation and other related matter associated with it.

| Income | Tax |

| $0 – $18,200 | 0% |

| $18,201 – $45,000 | Nil + 19% of excess over 18,200 |

| $45,001 – $120,000 | $5,092 + 32.5% of excess over 45,000 |

| $120,001 – $180,000 | $29,467 + 37% of excess over 120,000 |

| More than $180,001 | $51,667 + 45% of excess over $180,000 |

5. Netherlands

(Belastingdienst) The Dutch Tax and Customs Administration is a government organisation that is responsible for the collection and administration of taxes for Dutch resident.

Unlike other countries, the Netherlands chargesa wealth tax on the cryptocurrency

| Income | Tax |

| 50,000 or more | 31% Wealth Tax |

What is the First Step Towards Accepting Cryptocurrency?

Globally, wave of digitalisation swept everything that came in its way. With the ongoing pandemic and similar situation arising, we have understood that digitalisation; i.e. the likes of cryptocurrency, and bitcoin is definitely going to have major potential in the coming years. India, with one of the largest populations on the earth, attracts the maximum number of cryptocurrency users. Over the last few years, India has surpassed strong economies like the United States and China. The upsurge of cryptocurrency has forced the Indian Government to act upon the trend. And taxation of digital assets is going to be a key moment in the era of upcoming cryptocurrency in India.

Also Read: 10 Best Apps For Cryptocurrency In India