From addressing crises to innovating human resource solutions, PM Resources has become a leader in the dynamic Asia-Pacific region. Here’s how this trailblazing company has transformed how businesses manage their most vital asset—people.

01

02

From addressing crises to innovating human resource solutions, PM Resources has become a leader in the dynamic Asia-Pacific region. Here’s how this trailblazing company has transformed how businesses manage their most vital asset—people.

02

03

03

03

Cover Story

Exclusive insights and profiles of the innovators driving the future of business in the Asia-Pacific region.

Tech Innovation

Uncovering the latest advancements and disruptive technologies shaping the future of business and society

ALLEN Online: Revolutionizing Digital Learning for NEET and JEE Aspirants

In today’s fast world, digitization has undoubtedly been considered a game-changing factor that has brought highly resourceful quality education within the home comforts for the students. Among the most leading and well-known names for competitive preparation, ALLEN Online has carved its niche by assuring students of ultimate excellence. ALLEN Online, now redefined the entire gamut

MilesWeb’s Recipe for Web Hosting Excellence: Inside Story

Success isn’t magic; it’s a recipe. It is a combination of zeal, creativity, and unyielding dedication, all mixed into one potent dish. MilesWeb, the name behind reliable and high-performance hosting, has mastered the art of successful web hosting plans in the industry. But how are these success stories put together? Let’s examine what makes MilesWeb

How Technology is Reshaping the Travel Industry

The travel industry has undergone a dramatic transformation in recent years, driven by rapid technological advancements and shifting consumer expectations. Travelers today demand seamless experiences, personalized recommendations, and instant access to information. Whether booking a flight, reserving a hotel, or planning an itinerary, digital solutions have become essential for both travelers and businesses. Companies in

Why Secure Data Sharing Is a Key Business Strategy in 2025

In the modern digital business world, companies are increasingly depending on data to make decisions, improve customers’ experiences and stay competitive. But as reliance on data grows, it also boosts the necessity for secure and effective methods of sharing this information across different systems and businesses. A report shows that over 40% of CEOs consider

Magazine Issue

Delve into the latest trends and insights shaping the APAC business landscape. Each issue delivers in-depth analysis of key industries, profiles of leading innovators, and actionable strategies for growth.

Exclusive Interview

Direct access to the minds of APAC's leading figures, revealing their strategies and insights.

TechBiz Global: Bridging Talent Gaps and Software Needs in the International Tech Sector

The technology sector faces persistent challenges in securing specialized talent and developing innovative software solutions efficiently. These two factors – access to skilled personnel and the ability to execute technically complex projects – critically impact a company’s capacity for growth and its ability to compete effectively. Addressing these needs requires partners with both deep technical

TalentBridge: Developing Scalable Solutions for Assessment and Field Operations

Businesses today operate within a rapidly changing technological landscape. Effectively managing large-scale talent assessment and coordinating field operations present significant logistical and operational challenges. Traditional methods often prove inefficient, insecure, and unable to scale adequately to meet modern demands. Addressing these bottlenecks requires specialized technological solutions designed for practicality, security, and ease of use. TalentBridge

Robbert Murray & Associates: Combining Global Reach with Boutique Precision in Executive Search

The effective acquisition of management-level talent remains a critical determinant of organizational success. In an era marked by global talent shortages and rapidly evolving industry demands, businesses require recruitment partners capable of identifying, attracting, and securing candidates who not only possess the requisite skills but also align strategically with long-term objectives. Robbert Murray & Associates

Zeko AI: Applying AI Agents to Improve Hiring Efficiency and Reduce Bias

Initial discussions surrounding advanced Artificial Intelligence, particularly following OpenAI’s advancements, often centered on anxieties about job displacement. Headlines frequently warned, “AI is going to take our jobs.” However, the practical application of AI, especially Generative AI (GenAI), increasingly demonstrates its capacity to enhance productivity, streamline workflows, and augment human capabilities rather than simply replace them.

M. Arkam C. Munaaim: Building a Stronger Construction Industry

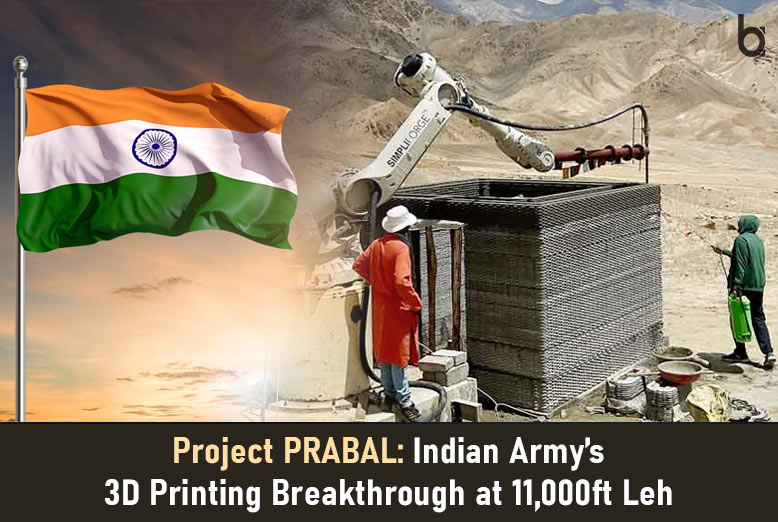

The construction and built environment industry forms the backbone of modern infrastructure. However, its workforce often operates without proper recognition and, at times, lacks the necessary qualifications for the important roles they fill. M. Arkam C. Munaaim, a skilled engineer, educator, and founder of Mega Jati Academy, recognized an opportunity to change this. Using decades

Jitendra Maharaj: Making Crypto Easy to Use

Imagine holding the future of money in your hands but not being able to use it to buy something simple like a laptop. This problem is what inspired Jitendra Maharaj to change how we use digital payments. In a world where cryptocurrency often seems confusing—too technical and too risky—Maharaj imagined something different: a way to

Suha Bakir: Courageous Leadership Redefining Furniture in the Middle East

In a vibrant region where tradition meets modernity, the furniture industry is seen as more than just a business—it serves as a means to enhance lives. In this setting, many companies find it challenging to balance heritage with the need for innovation. However, one leader stands out by harmonizing respect for the past with a

Raymond R. Tjandrawinata: Bridging Science, Innovation, and Humanity

During his postdoctoral fellowship at the University of California, San Francisco, Raymond R. Tjandrawinata experienced a pivotal moment. Surrounded by cutting-edge research and brilliant minds, he realized science wasn’t merely about discovery—it was about impact. This understanding shaped his career, propelling him from California’s labs to becoming a leading figure in Indonesian biopharmaceutical innovation. Today,

Recents Posts

Subscribe To Our Newsletter

Join the community of more than 80,000+ informed professionals

Women's Era

spotlighting the achievements and perspectives of influential women in the APAC business world.